September 2020

In the midst of these challenging times, here’s some good news for HV entrepreneurs! The HV Startup Fund has funds in the bank and ready to be deployed to HV entrepreneurs to help you grow your startup. See the Investor section below for more details to see if you are a potential fit and the simple steps you can take today to begin the process.

Entrepreneurs

Accel7 and Ulster County Economic Development Alliance (UCEDA) are proud to share our joint program Ulster RESPOND. Together, we are helping small businesses and entrepreneurs throughout the county respond to the 'new normal' of the COVID economy.

Into our first month of the program, we’ve recognized that our biggest takeaways come from sharing stories. This has fostered community and brought business owners together in a way that has not existed before. The stories of resilience and how businesses had to become more innovative than ever before have been very inspiring.

We saw how Lisa and Josh Sommers of Focus Media took to Facebook Live on Wednesdays hosting free content workshops. They wanted to provide their community with marketing strategies in an unprecedented time and in doing so, promoted their own business in a nuanced way.

We met with Julie Tallerman of Senate Garage, a converted event space that hosts weddings, corporate events, fundraisers, and music. Also, Judy is the co-owner of CoWork Kingston, a local co-working space in Uptown. Obviously, they had to do a ton of re-thinking very quickly. They decided to take precedent in helping their couples who were pushing back weddings first and foremost. Then, the co-working space came next. With little guidelines from the government, we discussed how with help from the community, they came up with their own safety guidelines.

Andrew Addotta of Hamilton & Adams and Amanda Stromoski of Rough Draft, both in Kingston shared their stories about how two retail businesses navigated in COVID. They both survived by engaging their customers online and moving a lot of the business to e-commerce. And as we've slowly come back, both have done really well with customers who are excited to be supporting local businesses and seeing familiar faces again.

During these webinars, it’s been awesome to see engagement among the group, talking about their personal stories and how they’ve seen the shift start to bring people in the community together.

Our platform also offers a variety of free resources and we aspire to provide innovative ways in which to support these small businesses.

Visit us at ulsterrespond.com.

For more information, contact Danny Potocki, danny@accel7.org

Investors

Hudson Valley Startup Fund Wants You!

The entrepreneurial ecosystem in the Hudson Valley is alive and well despite all that the pandemic — not to mention murder hornets, monsoons, derechos, and more — have thrown at us. Hudson Valley Startup Fund is an excellent example of this with 2020 activity including encouraging new investments, like Lessonbee, the online education platform, as well as exciting exits, like Simplecast’s acquisition by SiriusXM.

Though HVSF Fund I capital has been fully deployed, Fund II still has capital to put to work helping further strengthen the entrepreneurial ecosystem in the Hudson Valley — and grow your company.

What Kinds of Investments HVSF Seeks

HVSF invests in scalable businesses with a presence in the Hudson Valley. You do not necessarily need to be headquartered in the Hudson Valley, nor does your entire workforce need to be located here, but your company does need to contribute to the Hudson Valley economy to be considered for investment by HVSF.

The Fund also looks for strong teams who recognize their own capabilities and who would benefit from HVSF’s active, collaborative angel investing approach.

What HVSF Offers

The Fund offers business planning, fundraising and strategy guidance to support successful businesses seeking to grow and profit.

Fund members bring a wide range investment and business experience that can give you guidance you need. Portfolio companies have access to a large and diverse network that can make the introductions that will connect your business with the resources it needs.

Types of Investments

HVSF invests in seed and pre-seed companies and often makes follow-on investments in its portfolio companies. Seed Stage companies, HVSF invests up to $250k per company, typically staged with milestones and in the form of convertible debt.

For earlier stage companies, investments are typically in the $25,000 to $50,000 range.

How to Apply

To apply for funding, please visit HVSF’s Gust page. If you would like more information, please contact us through our website.

Not sure if your company is a good fit or want to introduce us to an entrepreneur you know? Reach out via email and we’ll respond ASAP.

Entrepreneurs and investors seeking more information on the HV Startup Fund can contact Andrew Schulkind, Managing Member, at info@hvstartupfund.com.

For more information about HVSF, please visit our website at www.hvstartupfund.com.

Leaders

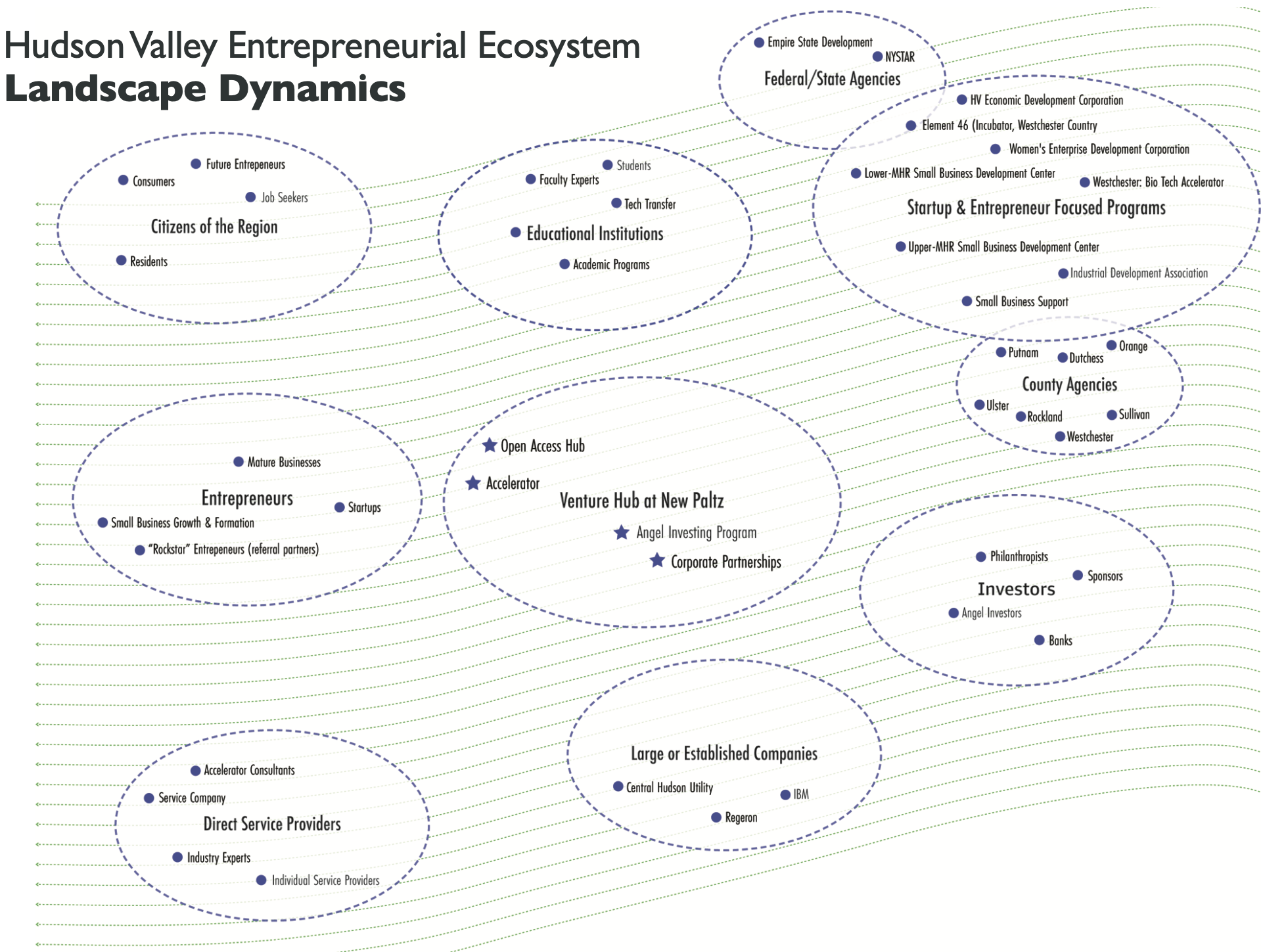

The HV Venture Hub is a strategic community engagement initiative of the SUNY New Paltz School of Business. Last month, we outlined two key projects designed to help the HV entrepreneur ecosystem become more visible and connected. Now we would like to ask for your support - help us to make you visible to the ecosystem.

There are three distinct ways you can become more visible within the HV Entrepreneur Ecosystem...

- As an individual: Over the next two months, we will be sending out an online form to all the participants of the ecosystem: Entrepreneurs, Leaders, Investors, Mentors, Services Providers, and Interested Parties.

- As an organization: We will look to one person in your organization to complete an online form that captures the essence of your organization and how you support entrepreneurs.

- As an organization: We will be building out and providing an index of resources that support HV entrepreneurs. It is intended to be a one stop shop for entrepreneurs to easily and quickly access valuable resources that can help them to succeed. This Resource Hub will be located on the HV Venture Hub website. We will use information collected from the organization forms (number 2 above) and confirm with you that you are listed as desired, before the index listing goes live.

This Ecosystem Mapping Initiative will help us to become a data rich ecosystem, as well as a more connected and collaborative ecosystem.

The HV Venture Hub at SUNY New Paltz School of Business is supported by:

- Kristin Backhaus, Dean, School of Business (backhauk@newpaltz.edu)

- Tony DiMarco, Entrepreneur in Residence (dimarcoa@newpaltz.edu)

- Lori Nutting, Director of Business Events & Marketing (nuttingl@newpaltz.edu)

- Jomara Gutierrez, HV Venture Hub Intern, School of Business, Class of 2021

Service Providers

Entrepreneurship program at SUNY New Paltz

SUNY New Paltz School of Business frequently asked question: “Someday, I’d like to start my own business… which major would help me prepare for that?” Answer: our entrepreneurship program! The entrepreneurship track prepares students to create, launch and manage a new company by incorporating hands-on entrepreneurship coursework with traditional business education. After gaining foundational knowledge in the areas of accounting, management, marketing, finance and analytics, students focus on new venture development, social entrepreneurship and business planning.

Over the past few years, our faculty have developed innovative projects that require students to step out of their typical student role. Chris Napolitano, entrepreneurship and management lecturer, assigned his class to develop a proposal for a business that could be located on a rural tract of land. Students had to investigate zoning regulations, building codes, planning board guidelines while putting together their business pitch. Another semester, students were assigned to develop an informational app for the School of Business, complete with prototype development. And every semester, entrepreneurship students participate in the business plan competition that culminates in a pitch competition judged by Hudson Valley Venture Hub leaders.

The entrepreneurship program leverages the HV Venture Hub community by engaging leaders and entrepreneurs as mentors, coaches and guest speakers. Our goal is to continue to integrate the Venture Hub with our program, encouraging students to launch businesses and join the ecosystem. And, we have recently submitted a proposal for the program to be elevated to a major, garnering greater visibility for the School of Business and a more specific credential for our graduates.

For more information about our program, please contact Kris Backhaus, Dean of the School of Business at backhauk@newpaltz.edu.

Before Silicon Valley, The HV

By Donald J. Delaney

Opportunity Awareness: The Wurts Brothers Delaware and Hudson Canal Company

Successful entrepreneurs continually scan for opportunities 24/7. William Wurts was a successful Philadelphia merchant - entrepreneur known for possessing a keen eye for commercializing an opportunity. He was also known for taking nature walks, at times weeks’ long walks. Taking nature walks was good for William’s health. It was even better for his wealth. And it led him to the Hudson Valley in 1823.

The early 19th century was a time of disruptions, especially in the Northeast. The British blockade cut off imports of bituminous coal into the U.S. prior to the War of 1812, good news for Western Pennsylvania’s abundant coal fields. The bad news- there was no transportation infrastructure into the #1 market - New York City. Entrepreneurship thrives on disruption.

Mr. Wurts liked to carry a notebook on his rambles into the unexplored woods of Northeastern, Pennsylvania. He began recording the geology he observed. He was standing on a ‘giant’ anthracite coal field. His entrepreneurial opportunity switch flipped to “on’.

In an instant, much like Alfred Smiley viewing Mohonk Lake for the first time, William Wurts conjured an entrepreneurial vision for his life’s work. Extract the valuable coal in Western Pennsylvania for the New York market. William’s first move was to share his good news with his brother Maurice, another echo with the Smiley Brothers.

Solving ‘wicked’ problems.

Successful entrepreneurs thrive on solving ‘wicked’ problems.

- Problem #1: Organize and fund a ‘startup’.

- Problem #2: Control ownership of their wilderness coal fields.

- Problem #3: Transport the coal 108 miles overland to the Hudson River.

- Problem #4: Be first to market. Time was of the essence.

William Wurts viewed each ‘problem’ as an opportunity for creating competitive advantage and potential profits.

Problem 1: In 2020 organizing a startup and securing funding is a “wicked’ problem but apparently not for William Wurtz. He gathered a group of angel investors to hear his ‘pitch’ in a Philadelphia coffee house. He ‘closed’ a startup round over coffee for $1,000,000. The value of that round in 2020 dollars would be worth $21,700,000.

Problem 2: With money in the bank and being very quiet about his remote discovery, William and his brother Maurice quickly secured ownership of the coal fields for a low purchase price.

Problem 3: 108 miles separated William’s coal in Honesdale, PA and the Hudson River in Kingston, NY. The challenge William faced in 1823 rivals, on a smaller scale, building the Panama Canal in 1914. William, entrepreneur, harnessed old and new resources and technologies to usher in the ‘industrial age’.

But first, he had to move millions of tons of anthracite coal over land, up a 600-foot mountain, then dig a canal, the final leg into the Rondout Creek in Kingston. And then onto the Hudson River for delivery to New York City and Albany.

Problem 4: Time is of the essence. The project was completed in three years by 2,500 laborers using the picks, shovels and mules. William, Maurice and their team were effective managers.

Source: Wikipedia (A remaining section of the canal in Sullivan County, NY, used as a linear park)

William’s infrastructure tool kit of innovation and invention contains a gravity railroad (envision an industrial ski lift), the first railroad engine in the U.S., 108 water powered locks, suspension cable aqueducts, and a host of bridges, ports and roads. Then add the constraints of a tight three-year timeline.

Source: Wikipedia. D&H Canal map, showing feeder railroads and competition, circa 1865

William Wurst the entrepreneur delivered. He delivered on time:

- The original ‘black gold’ on the Hudson.

- A multi-faceted transportation system from wilderness to market

- 10 - 24% profits.

- And, an entrepreneurial library of how to start, launch, manage and scale a ‘wicked’ opportunity’.

William and his brother Maurice, as a by-product, delivered fuel energy, technology* and talent** for the Industrial Revolution.

* Hydraulic cement - Rosendale, coal fired bricks, ...

**John Roebling went on to engineer and build the Brooklyn Bridge.

End Note: William Wurt was an ambitious and future-oriented entrepreneurial thinker. Much like John D. Rockefeller, his business model was transportation and distribution. He replaced his focus on canals and pivoted to railroads in 1864. In 1864 William renamed Delaware and Hudson Canal Company, the Delaware & Hudson Company, a new railroad company. D & H version 2.0 and William Wurt’s vision survived and thrived through many iterations and owners. The last D & H locomotives sporting the D & H brand colors were retired on September 19, 2015. Quite a run.

Source: Wikipedia. DH 605, an ALCO Century 628, in Binghamton, New York

This Before the Silicon Valley, the Hudson Valley blog offers a 400-year narrative journey honoring the icons of entrepreneurship and their impact on invention, innovation, and commercialization in the Hudson Valley.

Contact welcome: Donald J. Delaney, HV Entrepreneurship Historian & Blog Writer for the HV Venture Hub at SUNY New Paltz. You can reach Don at don@dondelaney.com

© Donald J. Delaney 2020

Events

- September 9,10 or 22 (Kingston): HVWiB Weekday Retreat on MONEY, 9:00am - 4:00pm, at the The Forsyth B&B

- September 10 (Potsdam/online): Upstate Capital presents Rural Access to Capital, 2:00pm - 4:00pm. Connect with investors and entrepreneurs to explore accessing capital in rural areas, and to discuss succession planning

- September 14 (Zoom): Hudson Valley Women in Business meeting on Subversive Chocolate and Pivoting Your Business, 1:00pm – 2:15pm

- September 16 (Zoom): Branding & Storytelling, 12:30pm-1:30pm, hosted by Community Capital NY, led by B Storytelling & Intend Creative

- September 24 (Buffalo/online): The Private Equity and M&A deal-making community is coming together to hear the latest from active investors, and make connections to facilitate deal flow for PE and M&A professionals, and how to prepare for M&A as buyers and sellers at Upstate Capital's Private Equity Summit.

- September 30 (Zoom): Digital Marketing 101, 12:30pm-1:30pm, hosted by Community Capital NY, led by WonderIN Group

- October 14 (Zoom): E-Commerce Part 1, 12:30pm-1:30pm, hosted by Community Capital NY, led by Chris O’Neal Design

- October 22 (Online): Invest NY: Energy, Transportation and Impact, hosted by Upstate Capital

- October 28 (Zoom): E-Commerce Part 2, 12:30pm-1:30pm, hosted by Community Capital NY, led by Chris O’Neal Design

Comments? Email Tony DiMarco at dimarcoa@newpaltz.edu

Newsletter Archive: | March 2019 | April 2019 | May 2019 | June 2019 | July 2019 | August 2019 | September 2019 | October 2019 | November 2019 | January 2020 | February 2020 | March 2020 | April 2020 | May 2020 | June 2020 | July 2020 | August 2020 | September 2020 | October 2020 | November 2020 | February 2021 | March 2021 | April 2021 | May 2021 | June 2021 | July 2021 | August 2021 | September 2021 | October 2021 | November 2021 | December 2021 | January 2022 | February 2022 | March 2022 | July 2022 | August 2022 | February 2023